Precious Metals for Barter or Exchange

We frequently get asked by our customers what they should buy in case the dollar crashes or would no longer be welcome in the marketplace. Given current monetary policy, a US Dollar crash no longer seems as unlikely a scenario as it once was. Even if, by some miracle, the US Dollar makes it through the current reckless “printing” we’ve seen over the past decades, we’re sure to see an elimination of cash and a move to a Central Bank Digital Currency (CBDC). Few people I know are looking forward to that level of surveillance and control.

Gold is likely too valuable or expensive for day-to-day transactions such as food and fuel. The smallest coin available from the US Mint is the 1/10th ounce Gold Eagle coin, which currently sells in excess of $200, well beyond its gold value alone. Some national mints also produce 1/20th ounce gold coins, still over $100 each. Smaller items like gram bars sell for $75 to $80 each, but it wouldn’t be helpful to buy something like, say, a dozen eggs or a gallon of milk. These smaller units of gold always carry high purchase premiums (the amount paid over the gold spot or market price) but may not return this premium in a barter exchange.

“But gold is divisible!” you say. Sure, a gram scale capable of accurately measuring a tenth of a gram will measure a few specks filed from your 1/10 Gold Eagle coin, but is the next guy going to believe it’s gold? It was a very credible coin starting out; now it’s been “clipped,” and the filings no longer carry the credibility and recognition provided by the intact coin. Good luck with that.

For thousands of years, the circulating currency in the general marketplace was silver. It served as the day-to-day cash system in much of the world. There is no better barter solution than silver.

But there are so many choices! What do I buy now to best guarantee and convenient, credible, and divisible option? Let’s take a look at some options:

1000-ounce silver bars are the cheapest way to acquire silver. If you find one to buy, it’ll be silver spot price plus any brokerage commission (1 to 3%). But at nearly 70 pounds and the size of a large loaf of bread, not exactly something you’re taking to the farmer’s market. Not at all practical.

Ten and 100-ounce bars are a better choice and carry a small maker’s premium plus a broker’s fee. Cheaper than one ouncers, but still too large to use in day-to-day commerce. Cutting or shaving them would result in a loss of credibility of the resulting pieces.

Privately minted one-ounce silver bars and rounds are starting to get more into the value territory but lack the credibility, recognition, and consistency of pattern provided by coins minted by recognized government mints. They carry a relatively low premium and are very popular with my clients that are stacking silver for the anticipated gains in the silver price. If something comes up and they need cash, they can bring a reasonably close to the amount required, and I’ll buy them. With ten and 100-ounce bars, you’re limited to the increments of, say, ten ounces and might not want to part with 20 ounces when you only need to sell 11 or 12 ounces.

Smaller privately minted bars and rounds exist, but premiums on these “fractional coins” tend to have higher premiums due to less availability. They tend to cost as much or more than the next item…

Government minted coins! Here we have a bunch of choices.

Silver American Eagles minted by the US Mint have been a mainstay of our business. Even though they are also the most expensive silver bullion coins, we sell. Americans are generally willing to pay the extra cost to have two main features – credibility and legal tender status (more on that later). Each coin is one full ounce of fine silver, has a consistent and attractive pattern full of liberty messaging and all the comforting national symbols.

Other countries also produce their own silver bullion coins, each denominated in their national or regional currency. Commonly available are Canadian Maple leaf coins, South African Krugerrands, Austrian Philharmonics, and Australian Kangaroos, to name our most popular. These tend to have a lower premium cost than Silver American Eagle coins and benefit from a consistent pattern over a long period. With the tremendous additional cost of Silver American Eagle coins, I’d argue that our neighbor to the north, Canada has a much lower cost and are likely to be just as credible as an American Eagle in a typical silver transaction.

Saving the best for last, my strong recommendation for the best silver for barter is 90% silver US coinage, old dimes, quarters, and half-dollars. We are all familiar with these coins and the symbols on them. It’s easy to discern the silver coins from not silver – look at the date. If a dime, quarter, or half-dollar is dated 1964 or before, it’s 90% silver and 10% copper. If it’s a Liberty (Mercury) head dime or a Franklin half-dollar, it’s silver. No need to even look at the date. They never made them any other way.

These coins are sometimes referred to as “Junk Silver.” That name initially indicated that coin collectors have screened out anything that might have additional collector value above the coin’s weight in silver.

One drawback is that these coins aren’t convenient fractions of a Troy ounce. The unit of measure is Troy ounces when we talk about gold, silver, platinum, and palladium coins. Nearly every commodity, such as produce and meat or dry goods like flour and sugar, are measured in Avoirdupois ounces. A Troy ounce is 31.1033 grams compared to the Avoirdupois ounce of 28.3495 grams. Just a quick note in case you want to check my upcoming math with your kitchen scale.

So an ounce of silver is heavier than an ounce of feathers.

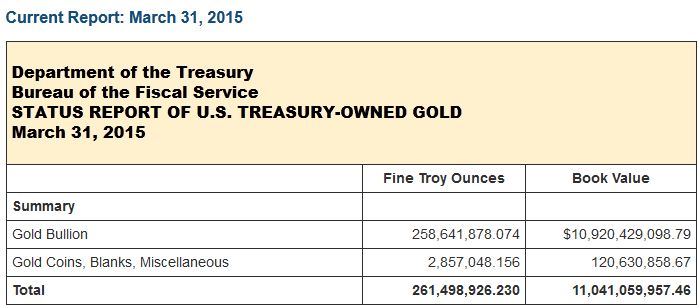

So, how much silver is in a face value dollar worth of 90% US silver coins? Very early in my precious metals education, I assumed it had to be .9 ounces because of the 90% label. I was wrong! The 90% refers only to the composition of the coin. It’s 90% silver and 10% copper. The combination resulted in a more durable coin and less likely to wear out than pure silver.

One dollar’s worth of these coins contained .7234 ounces of silver when they were newly minted. Since most of what we now see has been well circulated, most honest dealers use .715 ounces to account for the average wear of the coins. Whether you have ten dimes, four quarters or two half-dollars, or any combination equal to one dollar, you have .715 ounces of silver. We disregard the value of the other 10% (.0715 ounces) of copper.

So here’s the math:

If Silver is $25.00 spot price:

$1.00 of US 90% Silver coins is .715 ounces and has a silver value of $17.88 ($25 X .715 = $17.875)

A Dime, 1/10th of a dollar has a silver value of $1.79 (.10 X $17.88 = $1.788)

A quarter, 1/4th of a dollar, has a silver value of $4.47 (.25 X $17.88 = $4.46875)

A half-dollar, ½ of a dollar, has a silver value of $8.94 (.50 X 17.88 = $8.9375)

The magic conversion factor to remember is .715 X spot price = silver value of $1 face value

90% silver US coins used to be one of the cheapest ways to buy silver. Coins have gotten scarce in recent years as holders are less likely to want to let go of them. Silver stackers are looking for higher prices, and some want to keep it for potential barter or exchange. This has caused prices to climb to well over $20 per face value dollar in the wholesale market if you can find it.

But even at these higher prices, it is less expensive than Silver Eagles, which don’t provide the ability to barter in less than one-ounce increments. The recognition is easy, and the credibility is excellent. We’ve all seen dimes, quarters, and half-dollars. Is it silver? Check the date or symbols. It’s also very immune to fakes since you’d likely have to pay nearly a couple of dollars to make a fake dime, lousy ROI.

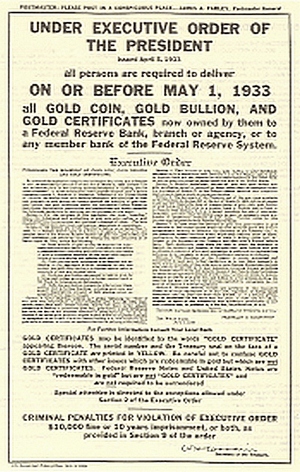

US 90% silver coins and Silver American Eagles are also legal tender – lawful money. What does that mean?

I’ll give a real-life example.

In early 2013, the political and social climate spurred a massive demand for firearms and ammunition. All of my local gun stores had virtually no guns and no ammunition. Amid all of this, I decided to shelve my 1911 and move to Heckler & Koch as my daily carry pistol. I was on the waiting list at a couple of shops for a long, long time. I remembered selling some metals to one local gun store owner a couple of years before and figured I’d give him a try. I sent him an email, and he quickly replied that he didn’t have that pistol available.

The next day he emailed me back, asking if I would be willing to pay in precious metals. I thought, why not? If it gets the job done…

After indicating a strong preference for silver, he magically found the exact firearm I wanted if I would pay the full list price in silver. Since most shops online were asking 125 to 150% over list, I figured it was a good deal. I loaded up some Silver American Eagles, some silver dimes, and quarters and headed to his shop.

When I walked in, the salespeople were having a conversation and largely ignored me. A quick scan of the shop showed empty shelves where the ammo used to be and largely empty gun display cases—just a couple of antique shotguns in the racks behind the counter that usually had scores of rifles. I introduced myself and asked for the owner. A few moments later was shown to his office.

He put the brand new H&K box on the desk and slid it over to me. He asked, “Whajya bring me?” pointing to the bag I was holding.

I pulled out two tubes of Silver American Eagles. We’d discussed $1200 for the gun, and with a slight reduction to my advertised price at the time, it would cover the basic retail price. He asked what was still in the bag, and I pulled out the bags of silver quarters and dimes, indicating I expected those to cover the taxes. I’d brought way more than necessary and expected to leave with the gun and some silver.

In an almost too serious way, he said, “You’re not leaving with any of that.” Not a hint of a smile on his face.

“Umm, what do you mean?” I replied with a gulp.

“Do you need some .45 ammo for that? He asked, pointing at the firearm.

I might have chuckled a bit and said, “I saw out front; you don’t appear to have any.”

He said, “I didn’t have any guns out there either, did I?”

“Good point,” I said

He went into a back room and returned with an unopened case of .45 FMJ. We finalized the price of everything, and he started writing it all up. He even used the pricing for the ammunition at the pre-mania cost.

When we got to the 7.5% sales tax, I stopped him. I pointed out that each of the coins I was using was assigned a US Dollar value and were legal tender, lawful money at face value. The Silver Eagles were $1.00; the rest were US dimes and quarters. So I was, in fact, only giving him $40 for the gun and 7.5% on that was a lot less than 7.5% on $1200.

He thought for a moment and said, “Huh, I paid a thousand dollars for that gun and hoped to make a couple hundred. Darned if I didn’t just lose $960.” Understanding that he had just reduced the apparent profit to his bottom line and thus the taxes he’d need to pay – a process we referred to as Wallet Voting.

With the new calculations and reduced sales tax, he gave me two more 50-round boxes of ammo for the rest of my silver and helped me carry it to my truck.

My point is that we don’t have to wait for the US Dollar to crash or for economic disaster to “vote” with the money we use. It’s getting easier to find folks eager to accept something besides ever-declining dollars for their effort or products. Seek out your own opportunities to barter for things you have or skills you possess and ask those you deal with if they are interested in barter. I’ve bought everything from meat to concrete and electrician’s services with metals. I’ve sold my backyard chicken eggs for silver.

It doesn’t hurt to ask; you may get a deal or motivate a seller to take that extra effort for you.

Tim Frey – President

Roberts & Roberts Brokerage, Inc.

850-478-5270

800-874-9760